India Fintech Foundation (IFF) is the result of a coalition of fintech founders, seasoned policy experts, and respected industry leaders who have come together with a shared vision—to build an independent, democratically run, forward-looking institution that can accelerate the role of fintech in nation-building in alignment with the regulators.

India Fintech Foundation (IFF) is a proposed Self-Regulatory Organization (SRO) dedicated to advancing the growth, innovation, and responsible development of fintech across India. As an industry-led body, we bring together fintechs, regulators, financial institutions, and policy-makers to foster dialogue, shape policies, promote responsible governance & transparent practises, and build a robust ecosystem needed to achieve a stronger and safer fintech future for our Viksit Bharat.

With deep roots in policy advocacy, regulatory collaboration, and community-building, IFF is designed to act as a trusted, transparent, and effective bridge between innovators and institutions—ensuring that India continues to lead on the global fintech map while staying aligned with national priorities.

ROLE OF SRO - India Fintech Foundation

Technological innovations are reshaping the financial services landscape, with FinTechs emerging as both disruptors and facilitators. FinTechs encompass diverse entities in terms of constitution, size, activities, domains, etc., all subject to constant flux and evolution.

As this innovation-led growth trajectory continues, the emergence of new business models, products, and services becomes inevitable, thereby making the need for a growing supervisory perimeter more and more critical for the responsible growth of the Fintech sector. This need underscores the critical role of the industry-led India Fintech Foundation to play a pivotal role in fostering a secure, responsible and sustainable fintech ecosystem.

LEADERSHIP TEAM

The India Fintech Foundation is guided by a diverse and visionary leadership team comprising industry veterans, fintech innovators, policy experts, and technology leaders. Together, they bring deep expertise and strategic insight to advance the mission of building a robust and inclusive fintech ecosystem in India.

IFF is a conglomeration of fintech leaders, enablers and experts representing the next phase of industry self-governance and ecosystem development. Drawing from the same leadership that has successfully driven and delivered several national fintech initiatives, IFF is now being shaped as an autonomous Self-Regulatory Organization (SRO) with a singular focus: to harness the transformative power of fintech for growth of India.

BOARD OF DIRECTORS & CEO

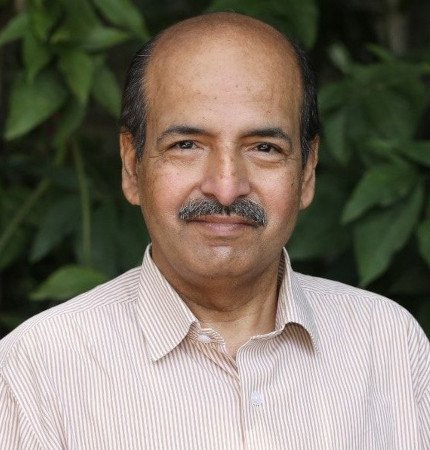

NS Viswanathan

Ex-Deputy Guv, RBI

Chairman, Axis Bank (NE)

Mustafa Muhammed

Ex-Chairman and MD -

SIDBI , NHB , CERSAI

Dhananjaya Tambe

Ex- Deputy MD & CIO

SBI

Sunil Kulkarni

CEO, BCFI, Chair of WG

Reserve Bank Innovation Hub

Harsh Vardhan Lunia

Founder

LendingKart

Jitendra Gupta

Founder

Jupiter

Anurag Sinha

Co-founder

Onecard

Chiranth Patil

Co-founder

Riskcovry

Sujith Narayanan

Co- Founder

Fi money

Srikanth Rajagopalan

CEO

Perfios AA

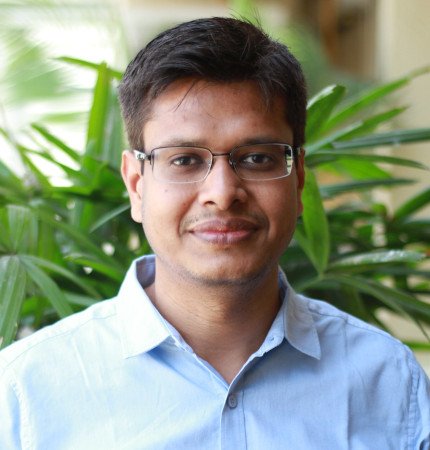

Sai Sudha

CEO, SRO - India

Fintech Foundation

GOVERNANCE MODEL

Key Principles

Democratic participation

with voice & vote to members

Transparency

in operations and decision-making

Diversity of representation

across business models, stages, and sizes

Checks & Balances

through layered review and stakeholder inputREGULATORY ALIGNMENT & MANDATE

Relationship with Regulator & GOI

Ongoing, transparent, and trusted relationship to ensure responsible growth & innovation

- Operates under principles and expectations outlined by RBI

- Formal bridge between the industry and the regulator

- Consultations, advisory meetings, and whitepaper submissions

Role in Regulatory Ecosystem

Key cog in regulatory architecture, ensuring clarity, compliance and consumer protection

- Voice of the Industry to represent a unified industry position

- Policy Enabler: Shares field-level insights to shape practical regulations

- Compliance Facilitator: Regulatory updates, Frameworks and practices

- Flags potential risks

Legal & Institutional Backing

Transparency, legal

soundness, operational accountability.

- Not-for-profit, Sec 8 company

- Neutral & non-commercial motives

- Complies with RBI's Guidelines

- Clear charter, bye-laws, and code of conduct approved by Board

- Structured mechanisms