A Night of Ideas at the IFF Panel discussion.

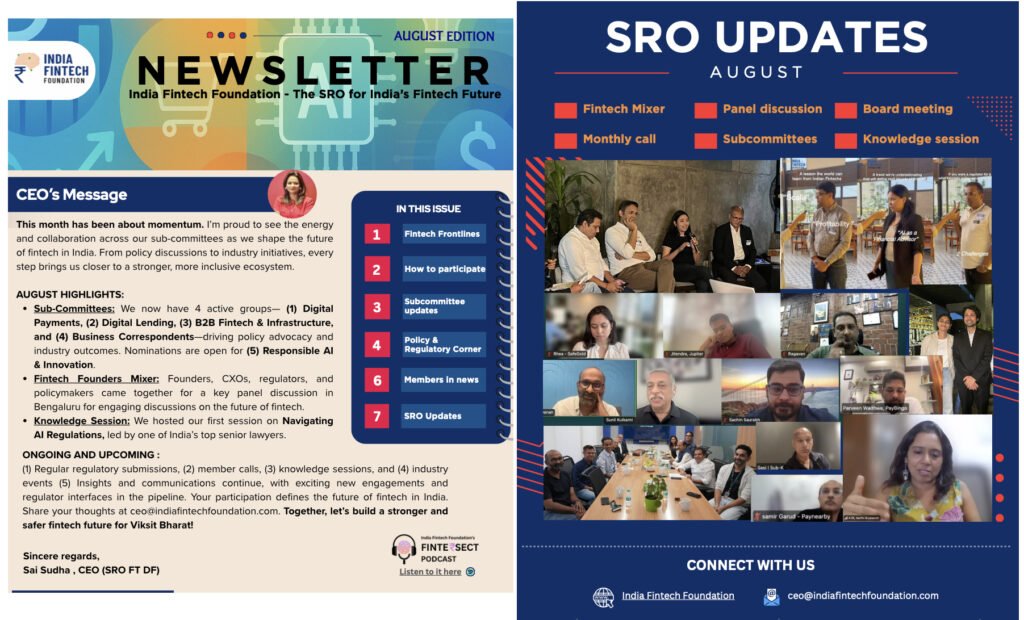

Bengaluru has always been a city of ideas, recently it played host to a different kind of energy — the India Fintech Foundation’s Fintech Founders Mixer. More than just a networking event, it became a stage for India’s fintech pioneers to engage in candid conversations about the future of financial services. The evening wasn’t about personalities; it was about practical challenges, bold experiments, and what it will take to make India’s fintech ecosystem globally relevant.

Here is summary for industry benefit on the key takeaways from the discussion.

Public Infrastructure: Catalyst or Competitor?

India’s fintech story is built on the backbone of digital public infrastructure — Aadhaar, UPI, and consent frameworks. These rails have brought down costs, opened access, and accelerated speed to market. Yet, as the panel noted, they can also reshape incentives. A key discussion was around if the state’s role in building infrastructure risk crowding out private capital? The consensus was that it depends on governance. Open, interoperable, and transparent rails multiply opportunities, while opaque systems risk entrenching incumbents.

The message to policymakers was clear: keep the rails open, and innovation will follow.

Account Aggregators: Who Gets to Play?

The Account Aggregator (AA) framework has already proven itself as a powerful mechanism for data consent and portability. But a big question remains: should non-regulated fintechs be allowed direct access? Optimism was high, with parallels drawn to how NPCI catalyzed UPI. If Unified Lending Interface (ULI) takes off, it could become the standardized backbone for lending data. Yet challenges around liability, interoperability, and transportability remain.

The takeaway : This is the moment for fintechs to lean in, participate in pilots, and help shape the standards that will define the next decade.

Digital Gold: Tradition Meets Technology

Sometimes innovation is about reframing the familiar. Digital gold was discussed as a prime example of product design that turns cultural affinity into financial inclusion. With over 70–80 million Indians already experimenting with digital gold, the product has become an entry point for novice savers. Low-ticket investments make it approachable, while features like leasing, micro-credit pledging, and instant redemption give it fresh utility.

Far from replacing traditional instruments, digital gold complements them — showing how design and trust can turn a static asset into a dynamic tool for inclusion.

Regulators, Fintechs and the Middle Path

India’s regulators are known to be more consultative than many of their global peers, yet a persistent gap remains. Fintech founders often feel regulators speak a different language when it comes to data use, AI governance, and emerging models.

This is where Self-Regulatory Organizations (SROs) can step in. Acting like the ICC or FIFA of fintech, SROs can synthesize industry voices, define codes of conduct, and build standards in unregulated spaces. For regulators, credible SROs mean less overhead and more confidence in industry practices. For fintechs, they mean a stronger, collective voice at the table.

AI in Finance: From Hype to Reality

AI has already moved past hype in fintech. The Mixer spotlighted real use cases — agent coaching, fraud detection, collections optimization, and compliance monitoring. These applications are already improving productivity and reducing risk. But when it comes to credit underwriting and high-stakes risk decisions, caution is warranted. The panel underscored that explainability, reproducibility, and human oversight are non-negotiable.

AI may be powerful, but without strong governance and clear data quality standards, its promise could quickly turn into peril.

Fintech 2030: Building for the Horizon

The final discussion cast an eye forward. The world of 2030 fintech will be faster, more digital, and deeply interconnected. Identity and records will be instantly verifiable, dramatically improving efficiency across compliance, hiring, and lending. Indian fintechs, with their horizontal platforms, could become powerful global exporters of technology. But one reality won’t change: regulation will remain central.

Innovators must build privacy-first, governance-ready, and globally adaptable architectures from day one. The winners will be those who design for compliance, not around it.

Five Takeaways for Founders

- Build for consent & interoperability – prioritize AA/ULI standards and join pilots.

- Make data governance part of product design – explainability and documentation build trust.

- Back credible SROs like India Fintech Foundation– collective standards elevate the industry’s voice.

- Be pragmatic with AI – use it widely for augmentation, tightly govern underwriting.

- Think global, ship local – refine in India, but design for international scalability.

IFF’s Role: Convening for Action

The Bengaluru Mixer reinforced a pragmatic truth: India’s digital rails are not a threat to private fintech — when designed well, they are multipliers of innovation. The real work ahead lies in making them interoperable, clarifying data rules, strengthening SROs, and deploying AI responsibly.

For IFF, this event was about more than conversation — it was about turning uncertainty into action. By convening founders, investors, and regulators on one floor, IFF created a space where competing perspectives found common ground. The path forward is clear: more pilots, more standards, and sustained collaboration to ensure that the rails we build today amplify — not absorb — the future of Indian fintech.

Contributed by Fellah, India Fintech Foundation