INTRODUCTION

India’s push for universal financial access hinges on grassroots networks that bridge the gap left by traditional banks. Business Correspondents (BCs)—local shopkeepers, retired professionals, NGOs and post offices—carry micro‑ATMs, biometric scanners, and mobile devices into villages, opening accounts and handling deposits within five kilometers of nearly every mapped hamlet.

BCs have transformed banking and lending in India’s hinterlands, delivering essential services where brick‑and‑mortar branches simply can’t reach.

OVERVIEW

Relevant links: RBI BC notification, DFS Annual Report, NABARD, RBI_National Strategy, NPCI, Ujjivan Bank

What is the Business Correspondent Model?

The Business Correspondent model ensures greater financial inclusion by acting as an intermediary between financial service providers and underbanked areas. A Business Correspondent (BC) is a representative of a bank that is authorised to carry out services like account opening, cash deposit/withdrawal, mini statement, etc. A BC is appointed by a bank’s Board of Directors after assessing the individual/entities, inter alia, financial soundness, management and corporate governance, cash handling ability, and ability to use technology for financial services. The banks are fully responsible for the actions of the BCs and their retail outlet/sub-agents.

The model aims to bridge the gap between lakhs of Indians who are unable to access formal banking and financial services by appointing local BCs equipped with the necessary digital tools, biometric devices, and updated information.

To expand financial access across the country, the RBI has allowed a wide range of individuals and institutions to serve as Business Correspondents (BCs). These include retired teachers, ex-bankers, government pensioners, shopkeepers, petrol pump owners, and those running Common Service Centres (CSCs).

Organizations like NGOs, MFIs, cooperative societies, post offices, and companies with large retail networks are also eligible, provided they meet RBI norms. The only major exclusion: Non-Banking Financial Companies (NBFCs) are not permitted to act as BCs.

“From retired teachers to shopkeepers, BCs come from trusted, familiar faces within the community, making banking more accessible and approachable.”

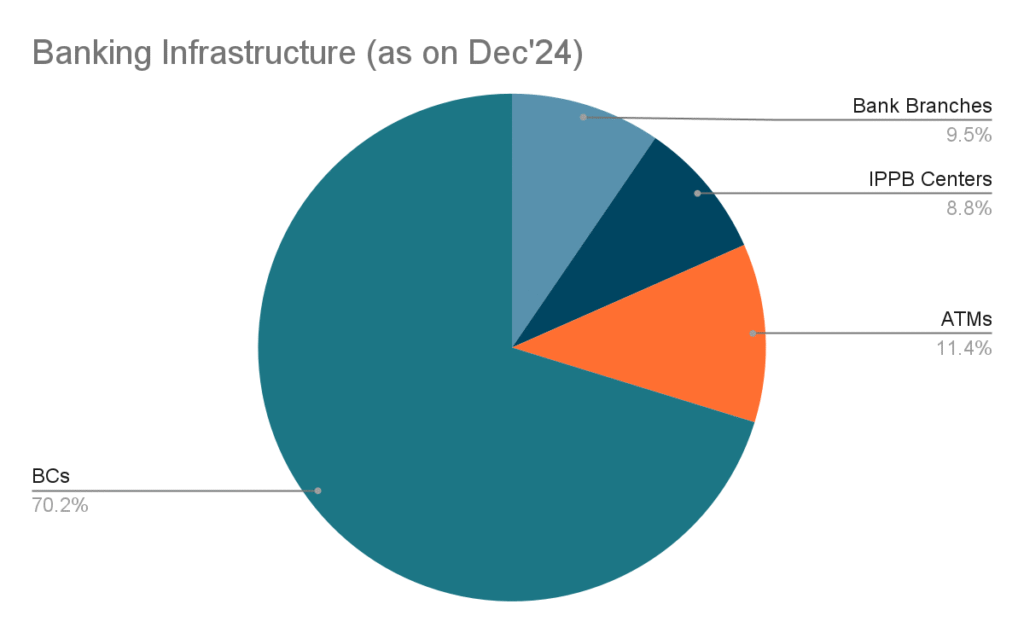

Banking Infrastructure in India

According to data provided by the Jan Dhan Dharshap (JDD) App, there are 1.77 lakh bank branches, 14.68 lakh BCs (including 1.64 lakh IPPB-BCs), and 2.11 lakh ATMs mapped by the banks.

Further, as per data uploaded by the banks on JDD app, out of the 6.01 lakh mapped villages on the app, 6.00 lakh (99.91%) villages have branches or a BC within a distance of 5 kilometres.

It is clear that the massive network of BCs in India is the primary financial access point to millions, especially in rural areas. It makes up for the lack of conventional physical banking infrastructure that many villages are deprived of.

Inside the Framework: from Policy to Practice

The Pradhan Mantri Jan-Dhan Yojana (PMJDY), launched in 2014, marked a turning point in India’s financial inclusion journey. To operationalize it, the government deployed Business Correspondents (BCs) across rural and underserved areas, enabling individuals without prior access to banking to open Basic Savings Bank Deposit (BSBD) accounts at bank branches or BC outlets.

BCs were strategically placed in Sub-Service Areas (SSAs), with each SSA covering 1,000–1,500 households, creating fixed and reliable banking touchpoints. Backed by micro-ATMs, biometric devices, and Aadhaar-based e-KYC tools, BCs ensured smooth Direct Benefit Transfer (DBT) flows—delivering pensions, MGNREGA wages, and welfare payments.

“The PMJDY is a real-life example of how public policy, technology, and grassroots intermediaries can create pragmatic changes to access financial services.”

RBI has supported this model since 2006 by enabling banks to appoint BCs, issuing clear eligibility guidelines. Further support came through the Financial Inclusion Fund (FIF) by NABARD and RBI in 2015, which facilitated BC training and digital enablement.

Recent policy changes in June 2025 eased KYC requirements, allowing BCs to update Aadhaar-based details on the spot, reactivating dormant accounts, and unlocking DBT payments for remote beneficiaries. The launch of the BC Registry and the IIBF’s certification programme further strengthens service quality and trust in the system.

With expanded permissions, BCs today also distribute micro-insurance, pensions, and even credit-linked services, solidifying their position as frontline agents of inclusive finance.

Conclusion: Bridging the Gap, Building Trust

India’s Business Correspondent model has evolved from a policy-driven experiment into a robust, tech-enabled delivery channel for financial services. By empowering local actors with digital tools and regulatory support, the model has helped unlock formal banking for millions.

What began as an outreach solution for remote villages is now a critical component of India’s financial infrastructure. With nearly every mapped village having a BC within 5 kilometres, and policies continuing to strengthen the ecosystem, Business Correspondents are not just intermediaries—they are the connective tissue of inclusive finance.

Contributed by Fellah Fajar, India Fintech Foundation