Shaping the Future of Ethical and Inclusive Innovation

“It is not the strongest of the species that survive, but the most adaptable to change.” – Charles Darwin

Artificial Intelligence (AI) is rapidly transforming the financial sector — from fraud detection to credit scoring to customer engagement. In India, where digital public infrastructure has already revolutionised payments and inclusion, the potential of AI is immense. But this potential comes with new risks — from bias and data privacy to systemic vulnerabilities.

Recognising both the opportunity and the challenges, the Reserve Bank of India (RBI) constituted the FREE-AI Committee (Framework for Responsible and Ethical Enablement of Artificial Intelligence). The Committee’s report, released in 2025, lays out a vision for how India’s financial sector can harness AI responsibly while safeguarding consumer trust and financial stability.

Why This Report Matters

AI is no longer a futuristic idea — it is embedded in everyday finance. Global investments in AI for financial services are projected to cross ₹8 lakh crore ($97 billion) by 2027. Generative AI alone is expected to grow at a CAGR of 28–34% over the next decade. For India, the stakes are higher: AI could enable financial inclusion for millions of underserved citizens through multilingual chatbots, alternate credit scoring, and voice-enabled banking.

Yet, the same technologies can introduce new vulnerabilities: algorithmic bias, opaque decision-making, cybersecurity threats, and risks to consumer protection. For regulators, the challenge is to strike a balance — promoting innovation without compromising safety.

The FREE-AI Committee’s mandate was to design that balance.

The 7 Sutras: Guiding Principles for Responsible AI

At the heart of the report are seven guiding principles, referred to as the Sutras, which provide the philosophical foundation for AI in Indian finance:

- Trust is the Foundation – AI must strengthen, not erode, confidence in the financial system.

- People First – Technology should serve human needs and respect dignity.

- Innovation over Restraint – The framework should enable experimentation while containing risks.

- Fairness and Equity – AI systems must avoid bias and ensure inclusion.

- Accountability – Institutions remain responsible for outcomes, regardless of technology used.

- Understandable by Design – Models must be explainable and transparent, avoiding “black box” decisions.

- Safety, Resilience and Sustainability – AI must be secure, robust, and aligned with long-term stability.

Together, these Sutras emphasise that AI adoption is not just a technological choice, but a matter of ethics, governance, and trust.

The 6 Pillars and 26 Recommendations

Translating principles into practice, the Committee structures its recommendations under six strategic pillars — three for enabling innovation, and three for mitigating risk.

Innovation Enablement

- Infrastructure: Establish shared data and compute resources to democratise AI access, especially for smaller players.

- Policy: Develop an AI policy for financial services, offering regulatory clarity and promoting innovation sandboxes.

- Capacity: Build skills at every level — boards, regulators, workforce, and consumers. Encourage indigenous financial AI models and knowledge-sharing across institutions.

Risk Mitigation

- Governance: Mandate board-approved AI policies within regulated entities. Ensure robust oversight throughout the AI lifecycle.

- Protection: Expand consumer protection, product approvals, and grievance redressal to cover AI use cases. Ensure customers know when they are interacting with AI.

- Assurance: Strengthen cybersecurity, incident reporting, and AI-specific audits to maintain resilience and accountability.

Through these pillars, the Committee delivers 26 actionable recommendations, ranging from AI innovation sandboxes and indigenous models to mandatory AI audits and consumer disclosures.

Role envisaged for the SRO (Recommendation #12)

“Framework for Sharing Best Practices: The financial services industry, through bodies such as IBA or SROs, should establish a framework for the exchange of AI-related use cases, lessons learned, and best practices and promote responsible scaling by highlighting positive outcomes, challenges, and sound governance frameworks.”

Insights from RBI’s AI Surveys

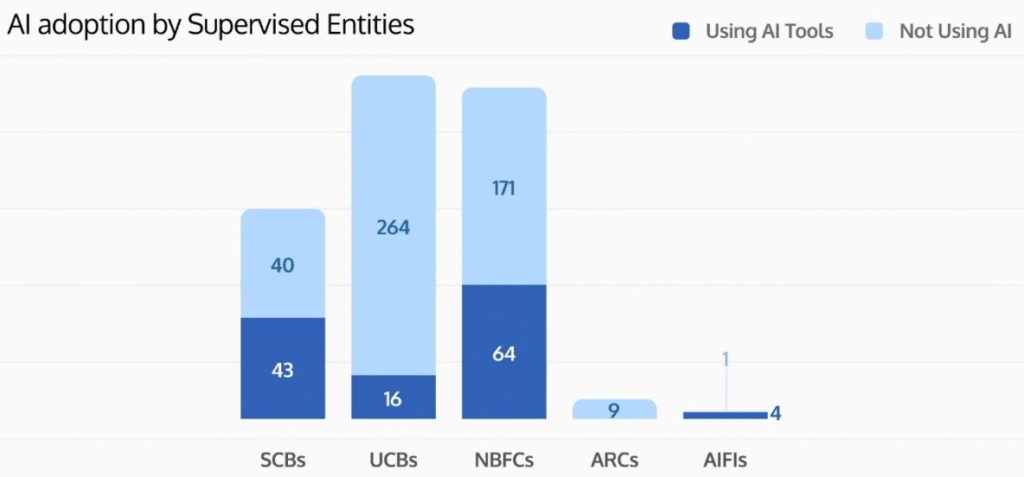

The Committee’s work was informed by two nationwide surveys conducted by RBI’s Department of Supervision and FinTech Department in 2025. These revealed a mixed picture of adoption:

- Adoption is uneven: Only 20.8% of 612 supervised entities were using or developing AI systems. Large banks lead adoption, while smaller NBFCs and cooperative banks lag behind.

Figure: AI adoption by Supervised Entities. Source: FREE AI Report

- Current applications are basic: Most AI is used for chatbots, predictive analytics, lead generation, and credit scoring. Advanced models are rare.

- Generative AI interest is high: 67% of surveyed entities are experimenting with GenAI, though mainly for internal use (chatbots, coding assistants) rather than customer-facing services.

- Inclusion use cases are promising: Stakeholders highlighted AI’s potential in alternate credit scoring, multilingual interfaces, automated KYC, and agent banking — but cited cost, sparse data, and ROI concerns as barriers.

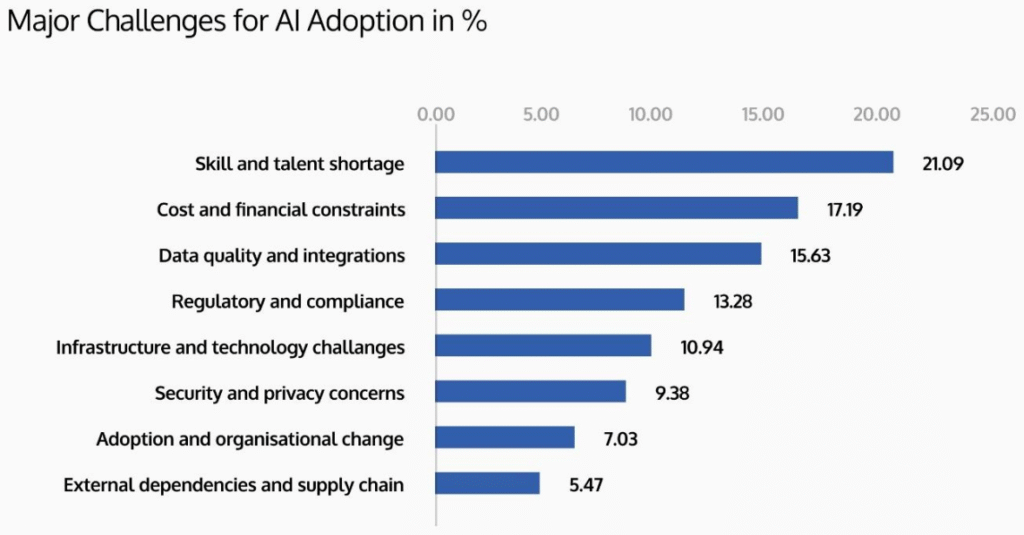

- Challenges remain: High costs, talent shortages, lack of high-quality data, and regulatory uncertainty hinder adoption. Smaller entities especially seek low-cost sandboxes to experiment securely.

Figure: Major challenges for AI adoption in %. Source: FREE AI Report

- Governance gaps: Only one-third of entities reported board-level oversight for AI. Few had formal risk mitigation or incident management frameworks.

Overall, the surveys underline both the promise and the readiness gaps in India’s AI adoption journey.

Global Policy Lessons

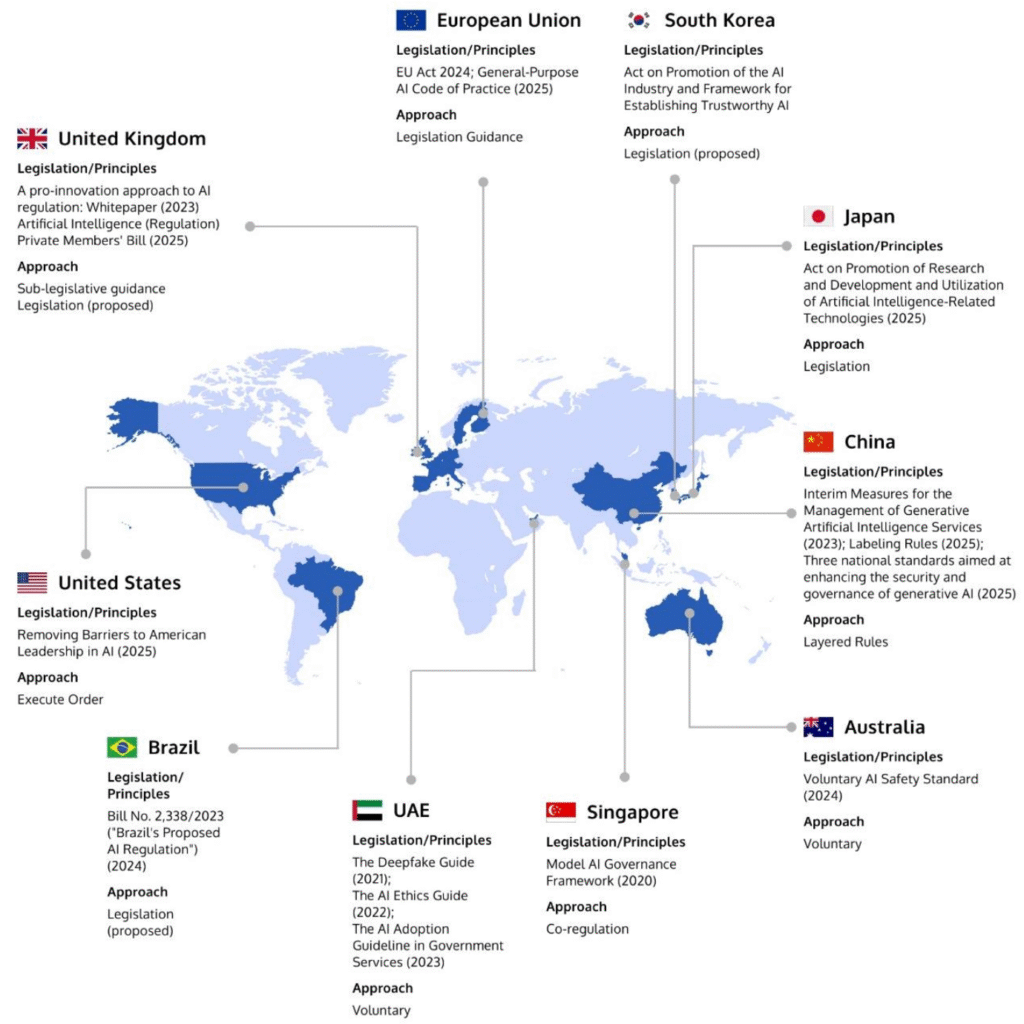

The report situates India’s approach within the broader global landscape. Different jurisdictions are experimenting with varied models:

- EU: Comprehensive AI Act, classifying applications by risk levels.

- China: Type-specific laws for generative AI, fake news, and algorithms.

- US & UK: Guidance-based, sector-led approaches with sandboxes and toolkits.

- Singapore: FEAT principles and multi-stakeholder governance, including a Responsible AI toolkit for fintech.

Figure: Global approaches to AI Regulation. Source: FREE AI Report

India’s stance, the Committee argues, should be pro-innovation, sector-specific, and adaptive, aligned with domestic priorities while learning from international best practices.

Key Risks Highlighted

The report identifies a spectrum of risks that demand proactive governance:

- Model Risk: Bias, explainability gaps, and model drift.

- Operational Risk: Failures in real-time systems can cascade into systemic issues.

- Third-Party Risk: Dependence on cloud vendors and AI providers creates vulnerabilities.

- Cybersecurity: AI can both strengthen defences and enable new forms of attack (deepfakes, data poisoning, adversarial prompts).

- Consumer Risk: Black-box models may disempower consumers; manipulative nudges raise ethical concerns.

- Financial Stability: Herding effects from similar models could amplify systemic shocks.

- Inertia Risk: Non-adoption could itself leave institutions behind, widening the digital divide.

These risks highlight why AI governance is not optional — it is essential for systemic resilience.

What This Means for Fintechs

For India’s fintech sector, the FREE-AI report is both a roadmap and a wake-up call.

Opportunities:

- Experiment with new models in regulatory sandboxes.

- Build multilingual, inclusive solutions aligned with RBI’s emphasis on financial inclusion.

- Collaborate on indigenous financial AI models and open data initiatives.

Responsibilities:

- Embed fairness, explainability, and consumer protection in product design.

- Develop board-level AI policies and governance early, even before mandates.

- Prepare for compliance frameworks that will expand to cover AI-specific risks.

Fintechs that align with the FREE-AI vision stand to gain trust, regulatory goodwill, and a leadership position in shaping the future of AI in finance.

Conclusion

The RBI’s FREE-AI report is not just about regulating a technology — it is about future-proofing India’s financial system. By combining innovation enablement with risk mitigation, it seeks to build an ecosystem where AI becomes a force for inclusion, trust, and resilience.

For fintechs, the message is clear: the future is not about choosing between growth and governance. It is about pursuing both, together.

As the report’s principles remind us, the future of finance in India will not just be digital — it will be intelligent, inclusive, and responsible.

Contributed by Anurag Kumar, India Fintech Foundation